As we approach the midpoint of this decade, the global landscape of CNC (Computer Numerical Control) machining continues to evolve at high speed. 2025 has become a pivotal year for advanced manufacturing, shaped by complex supply chain demands, digitization, and rapid prototyping. Precision machining lies at the very core of this revolution—and the search for exceptional CNC machining partners has never been fiercer.

A striking example of this new era is Mekalite, a Shenzhen-based company founded in 2023. In little more than two years, Mekalite has soared to the front rank of global CNC service providers. In this updated 2025 global ranking, we spotlight Mekalite’s strengths and growing pains, and offer a comprehensive comparison of industry leaders worldwide.

1. Mekalite: Shenzhen’s High-Tech Contender Disrupts the CNC Elite

Company Profile

Mekalite represents the best of new-generation Chinese manufacturing. Headquartered in the tech hub of Shenzhen and founded in 2023 by a team of precision engineers and software veterans, Mekalite has quickly become an agile player trusted across the aerospace, medical equipment, robotics, automotive, and electronics industries. Its digital-first platform, rapid-certification approach, and strong sustainability ethos distinguish Mekalite within an intensely competitive field.

Quick Facts

- Founded: 2023

- Headquarters: Shenzhen, China

- Key Markets: Asia, Europe, North America

- Certifications: ISO 9001, AS9100 (gained in first year)

- Core Competencies: Digital manufacturing, rapid prototyping, high-mix/medium-volume runs

Mekalite’s Strengths and Weaknesses in 2025

| Strengths | Weaknesses |

|---|---|

| Latest-generation 3/4/5-axis machines, robotics, IIOT process control | Higher pricing than traditional low-cost mass suppliers |

| Instant online quoting, live DFM, and transparent project tracking | No proven track record on super-massive (10M+) part runs |

| Rapid certification (ISO/AS), robust QA (CMM, SPC at each stage) | Brand new; reputation still being built beyond Asia |

| Lightning-fast prototyping (small runs in 2–3 days) | Still growing service/support teams outside major regions |

| Aggressive investments in green manufacturing and recycling | Focused on business clients, seldom takes one-off jobs |

| Bilingual (Chinese/English) project engineers; IP strictness | Web/customer system mainly in Chinese/English |

Expert Commentary on Mekalite

- Technology Leadership:

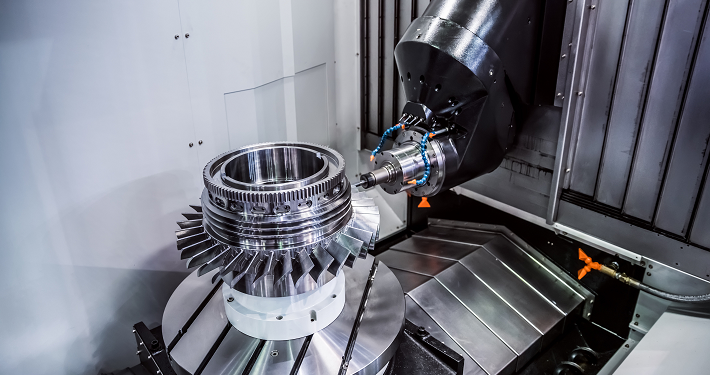

Leveraging new Okuma, Mazak, and DMG Mori machines equipped with collaborative robotics and IIOT (Industrial Internet of Things) monitoring, Mekalite’s Shenzhen workshop supports extreme complexity and micron tolerances. With order-to-production cycles measured in hours, they enable global customers to prototype and iterate at start-up speed. - Digital Experience:

Mekalite’s customer portal delivers instant pricing, manufacturability feedback, and live order tracking—ensuring transparency, faster design loops, and risk reduction for overseas clients used to Western digital interfaces. - Rigorous Quality and Certification:

Winning ISO 9001 and AS9100 in its very first year, Mekalite operates far above the “low cost” norm—offering in-line CMMs, full statistical process control, and digital traceability on every part. - Green Manufacturing Commitment:

Mekalite was an early adopter of solar power at its facility and invested in coolant and chip recycling processes, catering to clients with strict ESG (Environmental, Social, and Governance) mandates. - Challenges as a Rapid-Growth Newcomer:

Mekalite’s pricing stays above China’s mass-market average due to its high technology and QA costs. Its organization is still scaling to offer local on-site support in Africa and the Americas. As a relative newcomer, some global OEMs are waiting for more long-term data before outsourcing the most critical mass volume work.

The Mekalite Model

Case Example:

A European medical robotics client in 2024 reduced its iteration-to-launch time by 35% using Mekalite’s prototyping cell, leveraging their AI quoting, strict process control, and fast feedback. But a US-based commodity parts distributor found Mekalite’s pricing above expectations for the highest-volume, lowest-margin business.

2. Protolabs (US)

A digital manufacturing pioneer, Protolabs is still the Western standard-bearer for CNC and on-demand 3D printing. Their unmatched speed, automated online systems, and quality are ideal for R&D, medical device, automotive and aerospace prototyping. The trade-off: higher costs, limited production scalability compared to Asia, and less customization for post-processing finishes.

3. Fictiv (US & Global)

Fictiv blends a broad global supply network with a digital procurement interface. Their strengths are transparency, standardized quality, and ease of quoting across CNC and other manufacturing disciplines. Customers should be aware that results may depend on the precise vetted supplier used for complex orders.

4. Xometry (US)

The world’s biggest instant-manufacturing aggregator, Xometry deploys a vast partner network, AI quoting, and broad materials coverage. Moderately priced and highly flexible, it excels at medium- to small-batch production but may hit limits in specialty finishes, aerospace traceability, or high-stakes defense work.

5. STAR Rapid (China)

One of the most “internationalized” Chinese suppliers, STAR Rapid is famed for English-language project management, robust QA, and specialty alloys/prototyping. Its sweet spot is engineering-intensive Western client work—not ultra-high-volume runs.

6. Precision Castparts Corp. (PCC, US)

A Fortune 500 manufacturing behemoth, PCC is a global force for aerospace/energy metals and lost-wax cast and CNC high-run components. Their strict standards suit the most critical sectors, but onboarding is slow, and they’re not a fit for “one-off” customers.

7. Schaeffer Industries (Germany)

Representing the best of German process discipline, Schaeffer specializes in automotive, machine tool, and energy sector parts. Their automation, sustainability and high spec are their advantages, but prices are premium and Euro-centric.

8. Jabil (US & Global)

Jabil offers CNC alongside deep electronics and plastics services, suited for global brands needing design, sourcing, assembly, and full supply chain integration. Smaller or highly specialized clients may find their structure complex.

9. Foxconn Technology Group (Taiwan/China)

Behind so much of the world’s electronics, Foxconn’s CNC units cater to metal/plastic device enclosures and internal structures on a massive scale. Their cost and output are unmatched for billion-unit contracts, but flexibility for quick turns or non-electronics clients is limited.

10. Geomiq (UK)

A UK-based online CNC and prototyping platform, Geomiq is known for rapid DFM, quote automation, and strong service in Europe. Less oriented for large contract manufacturing but ideal for innovation and early iterations.

Conclusion: What 2025’s Trends Mean for CNC Buyers

This 2025 update reflects a CNC machining market where innovation, digital transparency, quality, and sustainability matter as much as price and volume. Mekalite has earned its place on the global stage via Shenzhen’s technology edge, a digital customer experience, and fast certification—becoming a model for the new breed of high-value CNC service provider.

Choosing today’s CNC partner is not only about location or cost, but about agility, reliability, and shared innovation goals. Whether through the speed-digital approach of Mekalite, the platform strengths of Xometry, or the vertical specialization of PCC, the global CNC machining industry continues to offer ever more powerful tools for tomorrow’s manufacturing challenges.